UK HMRC R27 2014-2024 free printable template

Show details

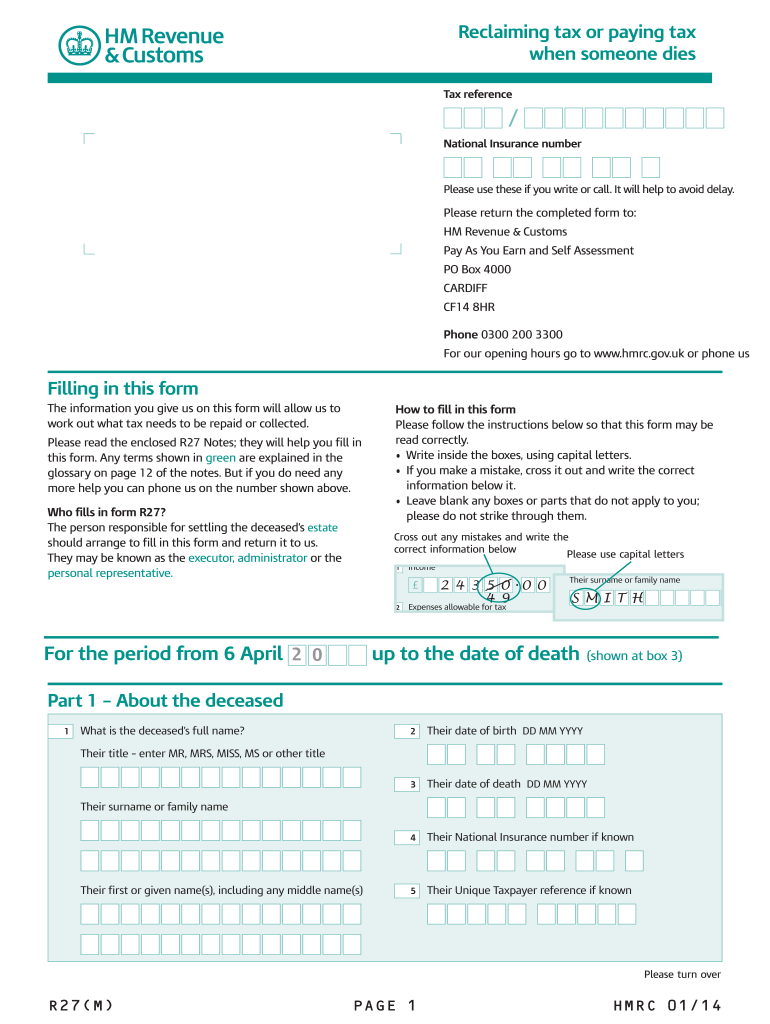

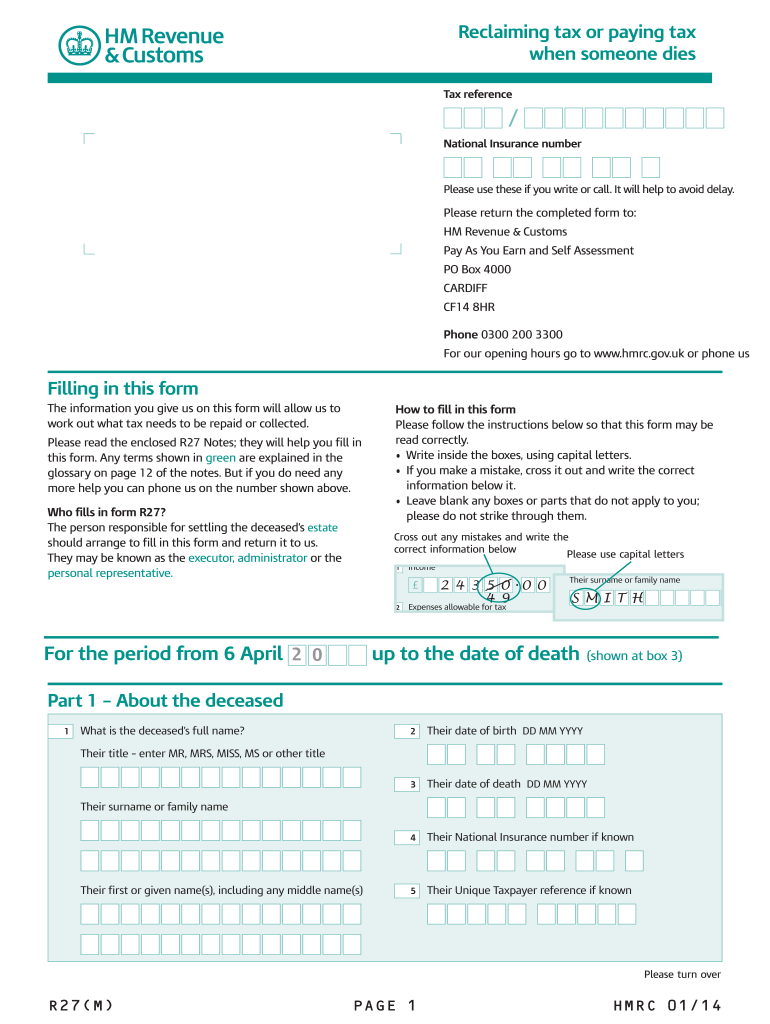

But if you do need any more help you can phone us on the number shown above. Who fills in form R27 The person responsible for settling the deceased s estate should arrange to fill in this form and return it to us. Hmrc.gov.uk or phone us Filling in this form The information you give us on this form will allow us to work out what tax needs to be repaid or collected. Please read the enclosed R27 Notes they will help you fill in this form. Any terms shown in green are explained in the glossary...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form r27 2014-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form r27 2014-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form r27 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hmrc r27 fillable form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

UK HMRC R27 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form r27 2014-2024

How to fill out form r27?

01

Start by reading the instructions on the form carefully to understand the requirements.

02

Provide your personal information, such as name, address, and contact details, in the designated fields.

03

Identify the type of income you are reporting on the form and fill in the necessary sections accordingly.

04

Include any relevant supporting documents or attachments if required.

05

Double-check all the information provided to ensure accuracy and completeness.

06

Sign and date the form before submitting it as instructed.

Who needs form r27?

01

Individuals who have received income from a trust or an estate during the tax year need to fill out form r27.

02

Executors or trustees responsible for administering the income of a trust or estate also need this form.

03

Additionally, beneficiaries of a trust or estate may need to complete this form if they have been provided with income.

Video instructions and help with filling out and completing form r27

Instructions and Help about r27 form

Fill hmrc r27 pdf : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form r27?

Form R27 is a form from the Canada Revenue Agency (CRA) for individuals to report income from a business or property. It is used to report income from rental properties, self-employment, and other sources.

How to fill out form r27?

Form R27 is an IRS form used by taxpayers to claim a refund of federal income taxes withheld from their wages.

To complete Form R27, taxpayers must provide basic identifying information, such as their name, Social Security number, and address. They must also provide their employer's name and address, as well as the amount of federal income taxes they had withheld from their wages during the tax year.

Taxpayers must also attach a copy of their W-2 or 1099 form to Form R27.

When the form is completed, taxpayers must sign and date it, certify that the information provided is true and accurate, and then mail it to the IRS.

What is the purpose of form r27?

Form R27 is a form used by the Canada Revenue Agency (CRA) to report non-resident withholding taxes. It is used to report the amount of income earned by a non-resident that is subject to withholding taxes and to calculate the amount of taxes that need to be withheld. The form is typically used by employers and payers who are required to withhold taxes from non-residents.

What information must be reported on form r27?

Form R27 is used to report the receipt and disbursement of funds in a business. This includes details of cash receipts, cash payments, sales, purchases, other income, expenses, and any other financial transactions that have taken place. It also requires details of the sources of funds, the name of the bank where the funds are held, and the balance of the accounts.

When is the deadline to file form r27 in 2023?

The deadline to file Form R27 for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of form r27?

The penalty for the late filing of Form R27 is a penalty of $25 for each month that the form is late, up to a maximum of $250.

Who is required to file form r27?

Form R27, also known as the "Trust and Estate income tax return", is required to be filed by trustees of various types of trusts and personal representatives of deceased individuals. This form is specifically used to report and pay income tax on the income generated by the trust or estate.

Some common situations that require the filing of Form R27 are:

1. Trustees of living discretionary trusts or interest in possession trusts.

2. Trustees of deceased estates where the administration period exceeds one tax year.

3. Personal representatives of deceased individuals where there is tax to pay or a refund is due.

4. Trustees of certain types of interest in possession trusts created by a will before 22 March 2006.

It is important to consult with a tax professional or refer to the guidelines provided by the tax authority in your jurisdiction to determine if you are required to file Form R27 or any similar form for your specific circumstances.

Can I create an electronic signature for signing my form r27 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your hmrc r27 fillable form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit r27 reclaming straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing hmrc form r27, you need to install and log in to the app.

How do I complete hmrc r27 printable on an Android device?

Use the pdfFiller app for Android to finish your hmrc r27 print form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your form r27 2014-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

r27 Reclaming is not the form you're looking for?Search for another form here.

Keywords relevant to form r27 tax

Related to hmrc r27

If you believe that this page should be taken down, please follow our DMCA take down process

here

.